Featured

Latest News

February 5, 2025

add comment

The factional of the All Progressives Congress (APC) led by Emeka Beke in Rivers State said Tony Okocha...

Lagos Lawmakers, GAC Reaffirm Mojisola Meranda as Speaker

February 4, 2025

add comment

February 5, 2025

add comment

Asadu Chidubem Jacinta, a young model from Enugu, is poised to represent Nigeria at the “Miss Teen...

February 5, 2025

add comment

The Nigerian Senate has threatened to issue warrant of arrest on some critical revenue generating agencies of...

Nigerians Now Begging for as Little as N1,000 to Eat – Shittu

February 5, 2025

add comment

February 5, 2025

add comment

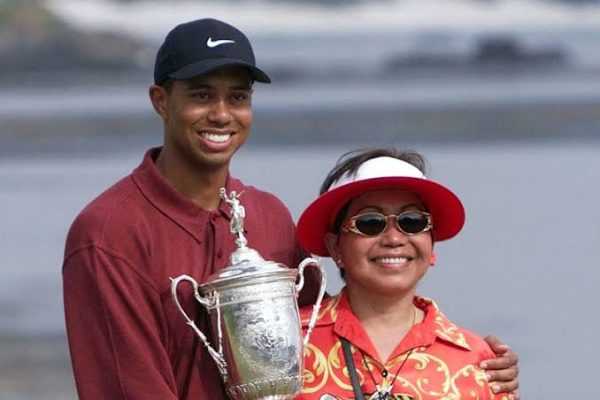

Tiger Woods announced on Tuesday that his mother Kutilda had passed away, paying tribute to his parent...

February 5, 2025

add comment

A South Carolina man has been charged with posing as a fake immigration agent in a traffic...

Stay Out of South Africa’s Issues, Ramaphosa to Trump

February 4, 2025

add comment

Philadelphia Air Ambulance Crash Leaves Six Dead

February 1, 2025

add comment

February 2, 2025

add comment

Dangote Petroleum Refinery has lowered the ex-depot price of petrol (PMS) from N950 to N890, effective Saturday,...

Spar to Charge ₦150 for Nylon Bags Following Government Ban

February 1, 2025

add comment

February 5, 2025

add comment

The recent killing of Onochie Abagana, a fisherman from Aguleri, has reignited tensions between the Aguleri and...

Can payment methods help online casinos to advance?

February 4, 2025

add comment

February 5, 2025

add comment

The Federal Government has said that Nigeria’s health sector has greatly improved so much so that it...

February 5, 2025

add comment

A 200-level Mass Communication student of the University of Ilorin, Kwara State, has allegedly committed su.!cide over...