Featured

Latest News

February 4, 2025

add comment

Members of the Lagos State House of Assembly, on Monday, apologised to President Bola Tinubu for initiating...

Lagos Lawmakers, GAC Reaffirm Mojisola Meranda as Speaker

February 4, 2025

add comment

February 5, 2025

add comment

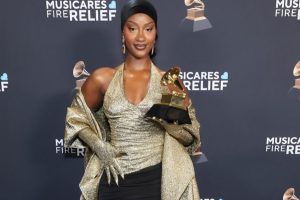

Tems has undoubtedly established herself as one of the most internationally recognized female Afrobeats artistes, but does...

Kanye West and Bianca On The Grammys Red Carpet (Photos)

February 3, 2025

add comment

Tems Wins Second Grammy Award for ‘Love Me Jeje’

February 3, 2025

add comment

February 5, 2025

add comment

Former Communication Minister, Adebayo Shittu has decried the high poverty rate in the country, saying many Nigerians...

I Am Proudly Igbo, No Criticism Can Change That – John Mbata

February 5, 2025

add comment

February 4, 2025

add comment

Chelsea fan sniffs Enzo Fernandez’s shorts after the Argentine midfielder threw them into the crowd at full-time...

Israel Adesanya Suffers Second Career Knockout Loss

February 2, 2025

add comment

February 5, 2025

add comment

US President Donald Trump has delayed tariffs on Mexican goods by one month, following an agreement with...

Stay Out of South Africa’s Issues, Ramaphosa to Trump

February 4, 2025

add comment

Philadelphia Air Ambulance Crash Leaves Six Dead

February 1, 2025

add comment

February 2, 2025

add comment

Dangote Petroleum Refinery has lowered the ex-depot price of petrol (PMS) from N950 to N890, effective Saturday,...

Spar to Charge ₦150 for Nylon Bags Following Government Ban

February 1, 2025

add comment

February 4, 2025

add comment

How many transactions do you make in a day? Whether you make two or ten, you probably...

Oborevwori’s Transformational Leadership in Delta State

January 26, 2025

add comment

February 5, 2025

add comment

The Federal Government has said that Nigeria’s health sector has greatly improved so much so that it...

February 5, 2025

add comment

A 200-level Mass Communication student of the University of Ilorin, Kwara State, has allegedly committed su.!cide over...